Life Insurance in and around Rockmart

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

When it comes to dependable life insurance, you have plenty of choices. Evaluating coverage options, providers, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Sherman Ross is a person with the knowledge needed to help you create a policy for your specific situation. You’ll have a no-nonsense experience to get cost-effective coverage for all your life insurance needs.

Protection for those you care about

Now is the right time to think about life insurance

Why Rockmart Chooses State Farm

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select should correspond with your current and future needs. Then you can consider the cost of a policy, which is determined by your age and your health status. Other factors that may be considered include body weight and family medical history. State Farm Agent Sherman Ross can walk you through all these options and can help you determine what type of policy is appropriate.

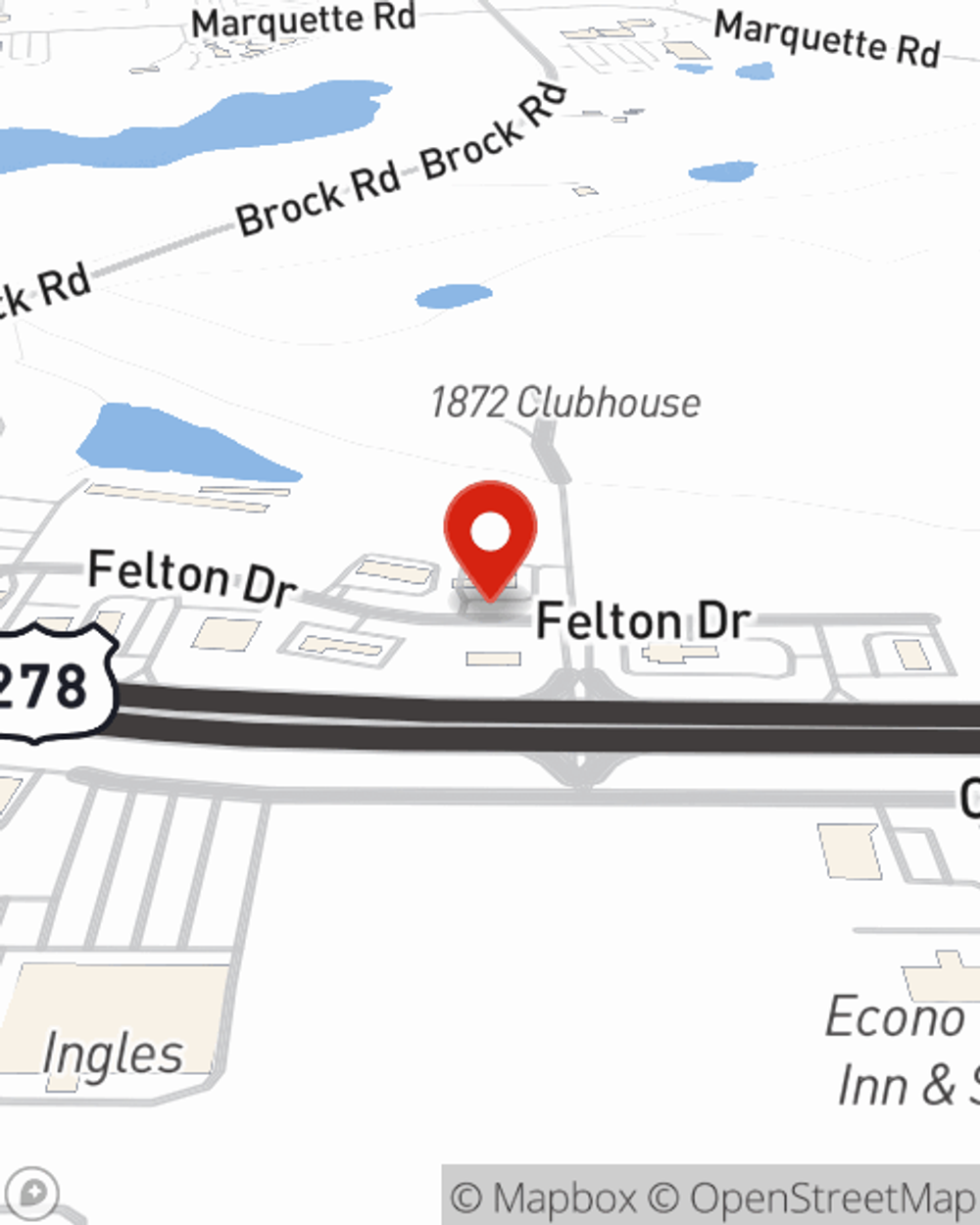

To explore what State Farm can do for you, contact Sherman Ross's office today!

Have More Questions About Life Insurance?

Call Sherman at (770) 684-3500 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Sherman Ross

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.